- The Hoot

- Posts

- The 56th Hoot

The 56th Hoot

Moment of The Decade: Crypto ETFs 🤩

Scatt's Seeds for Thought:

🌱Moment of The Decade: Crypto ETFs 🤩

🌱Why is Ethereum on a Run? 🤔

🌱10k Vendors Accept Bitcoin 🤩

🌱Our 4 Projections for 2024📊

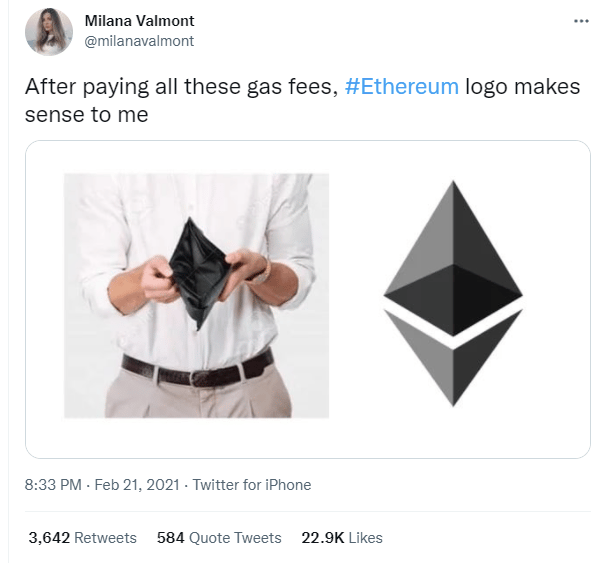

Meme of The Week

Year-to-Date Market Performance:

S&P 500: 0.29%

Dow: 0.26%

Nasdaq Comp: 0.26%

Bitcoin: 2.74%

Ethereum: 11.17%

Scatt Capital’s Fortune Strategy: 3.02% (Since Inception (12/22): 50.72%

Market News:

7-DAY CRYPTO MARKET CAP CHANGE: +$4BN

CRYPTO INVESTMENT PRODUCT FLOW: $151M

US INFLATION CAME IN HIGHER THAN EXPECTED

EU UNEMPLOYMENT DROPPED UNEXPECTEDLY

JAPANESE STOCK MARKETS HIT A 34-YEAR HIGH

BITCOIN FLOWS AT $113M FOR FIRST WEEK OF 2024

BLOCKCHAIN STOCKS ALSO SAW INFLOWS OF $24M

JPM STRATEGISTS SEE TREASURIES RALLY RESUMING

XI’S SOLUTION FOR CHINA TRIGGERING NEW TRADE WAR

CRYPTO JOB POSTINGS ON LINKEDIN DOWN 57% YoY IN DEC.

JAPAN E-COMMERCE GIANT MERCARI TO ACCEPT BITCOIN

LOGAN PAUL COMMITTED $2.3M TO BUY BACK CRYPTOZOO

BILL GROSS CALLS 10-YR TREASURY OVERVALUED AT 4%

$2.8BN US GOVT. WALLET DEPOSITING FUNDS ONTO EXCHANGES

SEC HACKED, FALSELY ANNOUNCES BTC ETF APPROVAL

$300M LIQUIDATED AS A RESULT OF THE ABOVE

BITCOIN DERIVATIVES MARKET VERY VOLATILE THIS WEEK

CRYPTO TRADING VOLUME HIGHEST LEVEL SINCE 2022

BIG MONEY MANAGERS SLASH BTC ETF FEES TO ATTRACT $$$

CATHIE WOOD PREDICTS BTC COULD HIT $1.5M

VANGUARD ARE BLOCKING ALL BITCOIN ETF CLIENT TRADES

JPM PREDICTS BTC MINING STOCK COOLDOWN

MICROSTRATEGY’S BTC NOW WORTH $1BN MORE THAN THE COMPANY

THE WEEK AHEAD:

Martin Luther King Jr. Holiday

U.S. Retail Sales

Housing Starts & Building Permits

Existing Home Sales

ETFs ARE FINALLY HERE 🤑

WE MADE IT!

This is argubaly the biggest moment in Bitcoin’s history. We are witnessing greatness.

Earlier last week, the SEC approved 11 spot Bitcoin exchange-traded funds.

For those that don’t understand… let me explain:

When a big institution/company/money manager (like BlackRock for example) wants to buy Bitcoin…

They buy in SIZE - I’m talking in millions, if not, billions.

So, do you think they use a VPN to buy $100m+ worth of Bitcoin on some random Israeli/Nigerian crypto exchange?

Absolutely not.

They want legitimacy and stability in their operations - which the big, traditional markets offer.

Up until now, they either haven’t had access, or the access has been questionable or indirect.

These ETFs open the door to potentially $100bn of inflows for the crypto market.

And on Thursday, we BROKE RECORDS: We hit $4.6bn in trading volume which is the MOST EVER for any ETF (yes, even bigger than the gold ETF).

Friends: The game has officially changed.

Why is Ethereum on a Run? 🤔

First Bitcoin, then Ethereum.

The last few months, Bitcoin has been RIPPING it up in price.

But ETH not so much… until recently.

Upon the ETF approval, ETH gained massively.

Why?

In court last year, ETH was officially considered a commodity.

Which makes the path to an ETH ETF very simple.

And as we previously mentioned… ETF = big inflow of cash from institutions.

Some guys (JP Morgan) are calling an ETH ETF as soon as May.

Giddy up 🤠

10k Vendors Accept Bitcoin 🤩

“But nobody even uses Bitcoin… what’s it even for?!”

Even though this is largely the case in the US, its not the same everywhere…

There are around 10,000 businesses & vendors who officially accept Bitcoin as a payment method.

Which is an increase from about 8,500 a year before.

As more & more people begin to realize the benefits and open up to accept it as a payment method, the closer we’ll get to REAL mass adoption.

Think of it as fractionalized gold (but better).

Our 4 Projections for 2024📊

There’s 2 things you need to know about us here at Scatt:

We’re always positive, and we LOVE making predictions.

Here are 4 we released in our end of year statement:

Bitcoin will break its previous all-time high (~$68k), but won’t hit $100k

Ethereum will outperform the broader crypto market

2024 will be the year institutions STAMPEDE into crypto

Real-world applications and use cases of crypto & blockchain will become more apparent

Fingers crossed - lets hope we’re right 🤞🏼

Check back with us in a year to see how well we did 🎯

If you like receiving market updates, check us out here on LinkedIn; here on Twitter; or here on Instagram 📊

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.