- The Hoot

- Posts

- The 69th Hoot

The 69th Hoot

Uniswap vs. The S.E.C. ⚔️

GOOD MONDAY & HAPPY MORNING ✍🏼🤨

WE ARE 5 DAYS FROM THE BITCOIN HALVING.

PUT YOUR BULL PANTS ON 🐂 👖

Scatt's Weekly Seeds:

🌱Hong Kong BTC & ETH ETFs 🤩

🌱Uniswap vs. The S.E.C. ⚔️

🌱Tether (USDT) Dominates 💰

🌱Long Term Bitcoin Holder Cycle 🔄

Meme of The Week

Year-to-Date Returns:

Dow: 0.78%

S&P 500: 7.41%

Nasdaq Comp: 7.75%

Bitcoin: 50.70%

Ethereum: 29.29%

Solana: 28.87%

News Breakdown:

Crypto Market:

7-DAY CRYPTO MARKET CAP CHANGE: $11B

CRYPTO INVESTMENT PRODUCT FLOW: $646M

TERRAFORM LABS & DO KWON FOUND LIABLE FOR FRAUD PVER FIRM’S COLLAPSE IN 2022

PANTERA CAPITAL’S FUND SURGED 66% IN Q1

RIPPLE’S CEO SAYS CRYPTO’S MARKET CAP WILL DOUBLE TO $5T BY YEAR-END

FIDELITY SPOT BTC ETF SURPASSES 150,000 BITCOIN IN AUM

1 THIRD OF CONSUMERS (IE. RETAIL MONEY/THE STUPID PEOPLE) BELIEVE BTC WILL FALL BELOW $20K BEFORE YEAR-END

BITCOIN WITNESSED LARGEST EVER PRICE INCREASE IN ONE MONTHS THIS FEBRUARY

Credit & Debt Markets:

10-YR TREASURY YIELD: 4.515%

ARES & BLUE OWL LEADING $4.8B DEBT PACKAGE FOR NOVO HOLDINGS $16.5B ACQUISITION OF CATALENT

TELECOM ITALIA SIGNED $1.6B BRIDGE LOAD TO COVER REFINANCING NEEDS UNTIL SALE TO KKR

SILVERLAKE LINED UP $8.5B IN DEBT TO FINANCE ITS LBO OF UFC-OWNER ENDEAVOR

EL SALVADOR PITCHED INVESTORS ON FIRST EUROBOND SALE SINCE 2020

BLACKSTONE TO BORROW $1B+ THROUGH A NAV LOAN BACKED BY DEALS IN $18B FLAGSHIP PRIVATE EQUITY FUND

This Week’s Economic Calendar:

U.S. Retail Sales (Monday)

Housing Starts & Building Permits (Tuesday)

Fed Chair Powell Speaks (Tuesday)

Home Sales (Thursday)

Hong Kong BTC & ETH ETFs 🤩

Another set of ETFs.

That’s right, ladies & gentlemen… there is a solid chance (as of writing) that Bitcoin and Ethereum ETFs could be approved in Hong Kong today (April 15th)

This would indicate an Ethereum ETF hit China before it did the USA.

Let that sink in for a second… and try comprehend what I just said.

When has the USA ever willingly let China beat her at anything EVER?!

But that’s besides the point… We saw the billions of dollars the Bitcoin ETFs in the US brought into the space.

Now let’s aggregate all the sidelined money in Asia and channel it all into these funds in Hong Kong.

All I’m seeing are BRIGHT GREEN CANDLES 🤑💚

Higher we go.

Uniswap vs. The S.E.C. ⚔️

Gensler strikes again.

Although, similar to the Biden situation, I believe the head of the S.E.C. is merely a puppet.

They announced yet another attack on crypto by delivering a wells notice to Uniswap.

Wells Notice = Essentially is a document that says “Congrats, you might be getting sued by the SEC, but at least we’re being polite about it by telling you first!

Uniswap = A decentralized exchange that allows users to swap their coins for another coin with ease

So as you can see this is not a good thing by any means.

It’s never fun having the Feds digging around in your back garden.

But also so unnecessary… to the point where someone needs to remind them of their responsibilities.

In my opinion, they are driving business & development away from the USA, and doing irreparable damage to the country (crypto as a sector will still find a way to flourish elsewhere).

A pure waste of resources.

Tether (USDT) Dominates 💰

More with less.

We’ve all heard the saying, but who’s actually done it?

Well, Tether just did. For multiple consecutive quarters.

As we all know, Tether is a company that makes and runs the Stablecoin (USDT) ie. the ‘dollar’ of crypto

Well the company produced an estimated $6.2bn in net income in 2023.

From a little magic internet coin? Wowza - maybe Scatt hasn’t just been talking sh*t all along and winding everyone up.

That $6.2 figure is 78% of what Goldman Sachs did ($7.9bn) and 72% of what Morgan Stanley did ($8.5bn).

Here’s the best part:

Goldman has 49,000 employees.

Morgan has 82,000 employees.

Tether has 100 employees 🔥

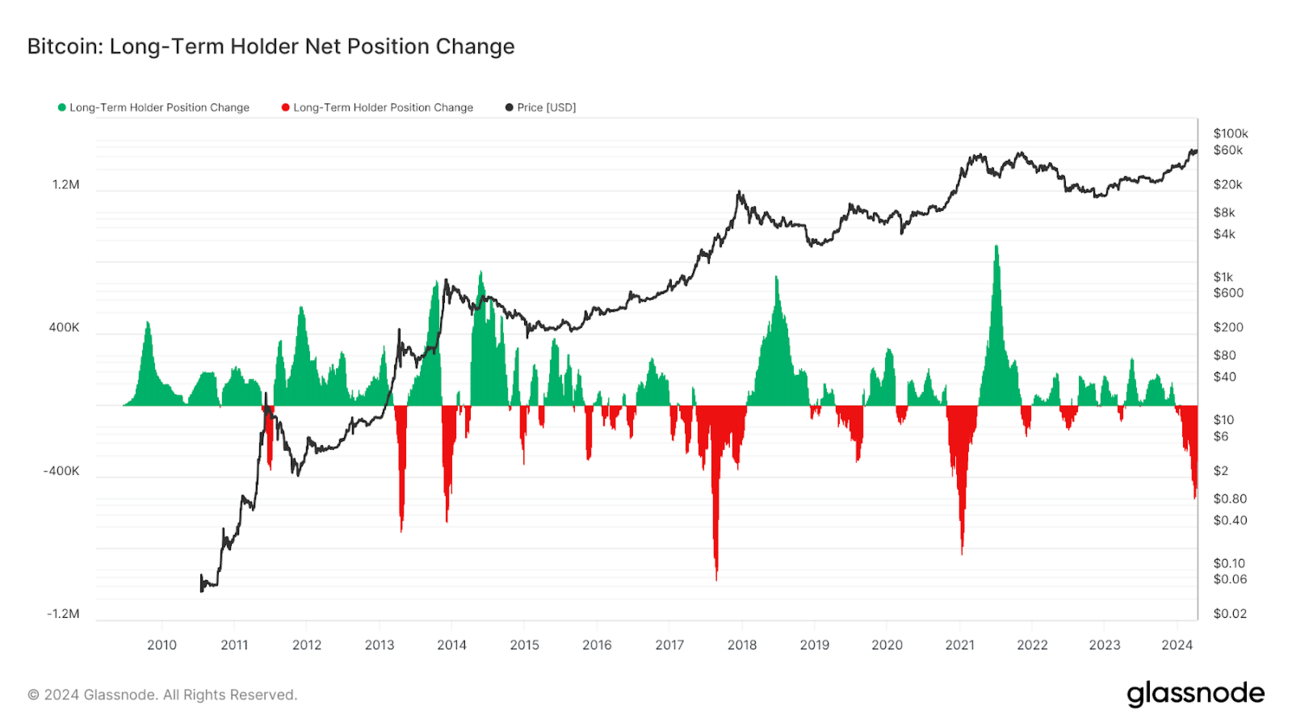

Long Term Bitcoin Holder Cycle 🔄

Things always move in cycles.

Bitcoin has been in the news a lot lately with people shouting “Volatility is back!”

Technically speaking, it’s correct in that price swings have become more violent.

But what you need to look at is the broader cycle and why that might be happening….

As with all markets, it’s impossible to boil it down to 1 thing, but one of the contributing factors is the fact that long term bitcoin holders are taking profits

See the graph below. Green is when the number of long term holders increases, and red the inverse.

How do I interpret this?

There is no reason to panic.

Essentially, this is a totally normal ‘changing of the guard’ so to speak.

As we can see from the chart, it happens every cycle when older long term holders exit/partially exit the market ie. taking profit, and newer investors enter

If anything, this is just proving that Bitcoin is about to go on an absolute tear of a run in the next 6-12 months.

Buckle up 🚀

Crypto Cold Storage Options:

Check us out on👇🏼:

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy, sell or hold any assets or to make any financial decisions. Please be careful and do your own research.