- The Hoot

- Posts

- The 76th Hoot

The 76th Hoot

Hold BTC or ETH? 🤔 + Preparing for a Bull Market 🐂

GOOD MORNING ☕️

EL SALVADOR’S BITCOIN PRESIDENT WAS JUST REELECTED.

FEELING HIGHLY CAFFEINATED AND SUPER BULLISH THIS MORNING.

Scatt's Weekly Seeds:

🌱Trump Continues to Win the Crypto War ⚔️

🌱Holding Bitcoin or Ethereum? 🤔

🌱Semler Scientific Goes BTC Route 💡

🌱How to Prepare for the Bull Run Coming Up 🐂

Memes of The Week

Year-to-Date Returns:

Dow: 2.64%

S&P 500: 10.64%

Nasdaq Comp: 11.48%

Bitcoin: 62.57%

Ethereum: 65.88%

Solana: 57.41%

News Breakdown:

Crypto Market:

7-DAY CRYPTO MARKET CAP CHANGE: $3B

CRYPTO INVESTMENT PRODUCT FLOW: $1.05B

UK WOMAN SENTENCED TO 6 YEARS OVER $5.6B CHINA BITCOIN FRAUD

BLACKROCK’S IBIT ETF NOW THE WORLD’S LARGEST BTC FUND & FASTEST EVER TO HIT $20B

FTX EXECUTIVE SENTENCED TO 7.5 YEARS IN PRISON

NYSE ANNOUNCES COLLAB WITH COINDESK INDICES TO TRACK SPOT BITCOIN PRICES

MASTERCARD CRYPTO LAUNCHES PEER-TO-PEER PILOT TRANSACTIONS WITH MERCADO

CRYPTO VC AND HEDGE FUNDS ARE LAUNCHING AT FASTEST PACE SINCE 2021

FIRST LEVERAGED ETHER EFT LAUNCHES IN U.S. (THIS IS DIFFERENT TO A SPOT ETF)

Credit & Debt Markets:

10-YR TREASURY YIELD: 4.490%

FRENCH BATTERY STARTUP VERKOR SECURED $1.4B IN GREEN LOAN

SUBWAY SELLING $3.35B OF ABS TO FINANCE LBO, LARGEST SECURITIZATION OF ITS KIND

BLACKSTONE BOUGHT $1B MORTGAGE PORTFOLIO FROM GERMAN RE LENDER

CHINESE DEVELOPER IN TALKS FOR A $6.9B LOAN

AUSTRALIA WOODSIDE SECURED $1B LOAN FROM JAPAN BANK FOR INTERNATIONAL COOPERATION TO DEVELOP NAT GAS PROJECT

This Week’s Economic Calendar:

Construction Spending (Monday)

Bank of Canada Rate Decision (Wednesday)

Consumer Credit (Friday)

U.S. Unemployment Report (Friday)

Trump Continues to Win the Crypto War ⚔️

I feel like I speak about this every week.

But there is a reason: Politics matter to markets, and crypto has become important in politics.

Biden just vetoed the ONLY PRO-CRYPTO bill to ever come across his desk.

SAB 121 is an anti-crypto rule put in place by Gary Gensler (SEC) to stop banks from holding crypto. We hate it. The banks hate it.

All he had to do was not veto the repeal.

This in itself will likely cost the Dems in November.

On the other hand, Trump:

Is the first presidential candidate to accept Bitcoin/Crypto as political donations

Talks with Elon Musk about a potential advisory role for Elon if Trump wins (and about crypto adoption and integration)

Who’s winning?

Guess we’ll find out in November.

Holding Bitcoin or Ethereum? 🤔

Michael Saylor is a legend.

By choosing to invest in Bitcoin over Ethereum, Saylor missed out on an extra $5.7B in additional profit…

Since 2020, he’s been buying Bitcoin like nobody else, investing a total of $7.57B to amass 214,246 BTC which is now worth about $14.76B (+95% or +$7.19B).

Had they bought Ethereum instead:

They would own 4,986,791 ETH worth about $18.6B (+146% or +$11.06B)

Had they STAKED their ETH at roughly 4% APY, they would have earned an EXTRA 489,985 ETH (or $1.83B)

This would then amount to $20.46B

If he sold ALL his Bitcoin now, bought ETH and then staked it…

He would have about 4 million ETH that would bring in about $738M in annual revenue. This is more than his company has ever made in a year.

He’s a fundamental player though, and an investment in ETH would likely have carried significantly more risk.

No judgement towards him - purely an observation.

He will still very likely become the world’s first Bitcoin billionaire.

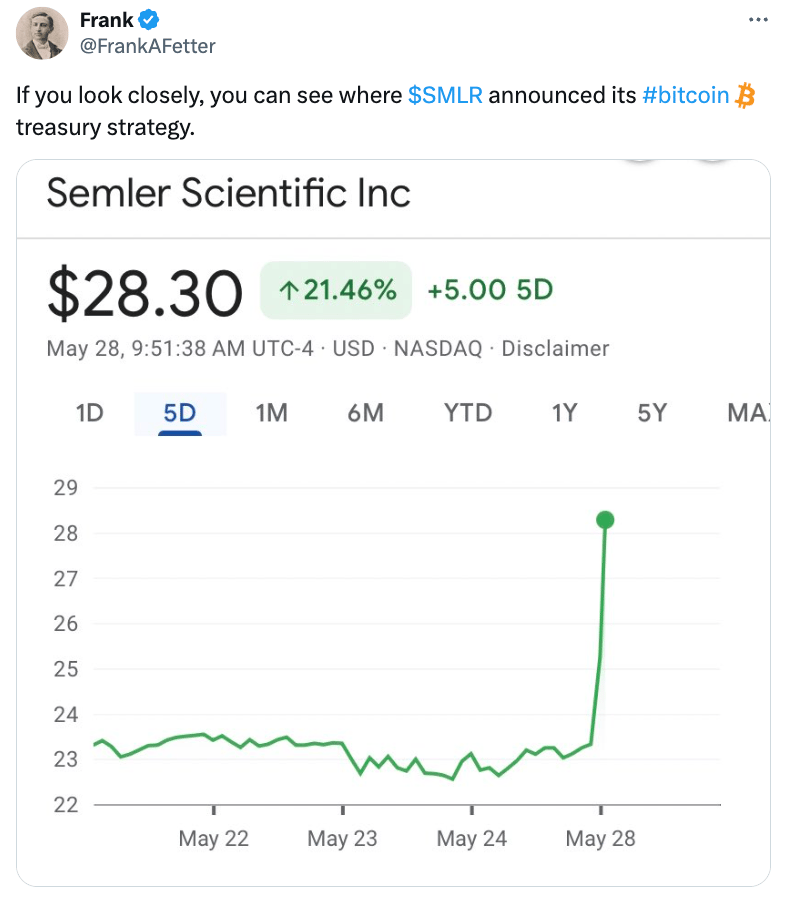

Semler Scientific Goes BTC Route 💡

Semler is a NASDAQ listed healthcare company.

And they just went full crypto and decided to stash most of their cash in Bitcoin.

They believe that BTC is the ultimate long-term store of value, and best way to dodge inflation.

They recently announced that they bought 581 Bitcoin, worth about $40M.

About 63.6% of their treasury now sits in BTC.

We’ve seen this trend before with Tesla in 2021 (which we love btw), but it begs the question as to what would happen if the biggest 5 companies allocated just 1%?

Apple, Amazon, Meta, Google and Microsoft (random big 5) would add up to about 94,000 Bitcoin (or ~0.5% of total supply)

And that’s just 1%.

Think on a bigger scale and what that would do to prices.

How to Prepare for the Upcoming Bull Run 🐂

The bull is here.

We are on the cusp of people making A LOT of money in a very short period of time.

But those large sums of money don’t come from Bitcoin going up 140%. So we need to understand where the opportunity lies…

And that is in what we call alt coins (smaller alternative coins to BTC). Alts will outperform every single day of the week in a good market.

So if we are bullish on BTC and we know that ETH is somewhat tied to BTC performance, but every move is more amplified (or leveraged as we say), why hold Bitcoin?

Shoutout to @MaxBecauseBTC for the chart yet again!

Listen, at the end of the day everyone has different needs and risk tolerances so do whatever makes you feel comfortable.

But understand the flow of money and what that will do to your returns if you are positioned correctly:

Money flows from BTC → ETH → Large Cap Alts → Small Cap Alts

And small cap alts is where the 10-500x returns truly lie.

So the question becomes: How comfortable are you being uncomfortable in the short term for a long term gain?

Crypto Cold Storage Options:

Check us out on👇🏼:

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy, sell or hold any assets or to make any financial decisions. Please be careful and do your own research.